Illinois legalized online sports betting in 2020 and dozens of online sportsbooks are now operating in the state. In this guide, we’ll cover everything you need to know about online sports betting in Illinois, whether it is offshore or regulated online in Illinois.

In this guide, you’ll discover offshore sportsbooks that offer great alternatives to Illinois sports betting sites. It includes info about each site’s collection of sports, how great the markets are, and details on the sports bonuses available.

Illinois Sports Betting at a Glance

Illinois retail sportsbooks and online apps started taking bets in 2020. Sports betting in the state is hugely popular with a record of over $840 million wagered in one month. The current sports betting market in the state is outlined below.

- Legal Sports Betting: Regulated Retail and Online Sports Betting

- Minimum Sports Betting Age in Illinois: 21 (inland), 18 (through offshore sites)

- Offline Betting in Person: Yes available at casinos, sports stadiums, and racetracks

- Online Sportsbooks: Inland and offshore

- Live/In-Play Betting: Inland and offshore

- College Sports Betting: Inland (cannot bet on Illinois teams online and player props and in-game betting are unavailable for instate teams), Offshore (available online with no restrictions)

- Horse racing: Inland and Offshore

- Estimated Sports Betting Revenue: Over $1.9 billion

- Permitted Sports Betting Operators: Multiple casinos, racetracks, and Wrigley Field home of the Cubs

- Licensing Fee: $10 million ($20 million for online-only license) and a million-dollar 4-year renewal

- Tax Rate: 15%

- Tax Funded: The Sports Wagering Fund with any excess funds going to the Capital Projects Fund.

Timeline of Sports Betting Legislation in Illinois

Since the in-person registration on mobile sports betting accounts was lifted in March 2022, there have been some key milestones such as total handles in the state. However, there have not been any updates on sports betting as it is fully and completely legal.

- January 2023: HB1405 is introduced by Illinois Rep Robert Rita. This bill would allow betting exchanges to operate in the state.

- March 2022: The requirement of in-person registration to bet on sports in Illinois was lifted. This was met with widespread approval by many pro-gambling supporters throughout the state.

- August 2021: The Illinois Gaming Board published applications for the state’s three online-only sports betting licenses. A license costs $20 million and it is unclear if any sports betting outfit will apply for them at this time. The in-person registration requirement will be lifted if and when an online-only sports betting license is issued.

- April 2020: Illinois Governor JB Pritzker suspended the requirement for sports bettors to register in person in response to the COVID-19 pandemic. The requirement was reinstated in June, suspended again in August, and then reinstated in April 2021.

- June 2019: The Illinois legislature passed a bill that legalized sports betting and doubled the number of casino licenses available in Illinois. The bill was being amended right up until it passed, and the final language excluded online sportsbooks from receiving their licenses for 18 months – although they could partner with existing Illinois casinos. After 18 months, three licenses would be available for online-only sportsbooks. In addition, bettors would be required to register for online sports betting accounts at in-person casinos.

- May 2019: Illinois Rep. Mike Zalewski introduced a bill to legalize sports betting. It included unusually high fees and an 18-month waiting period for online sportsbooks and was widely criticized by the sports betting industry.

- 2018: 5 bills to legalize sports betting were introduced to the Illinois legislature this year, although they were primarily intended to explore the possibility of regulating sports wagering.

List of the Best Illinois Sportsbooks in 2025

The number of online sites for sports betting in Illinois is quickly growing. If you’re new to the online sports gambling scene in IL, here are our top 10 picks for placing a wager:

- BetOnline – Overall best Illinois sports betting site for 2025

- BetNow – Deeper markets than most other IL sports betting sites

- Bovada – Best online sports betting Illinois site for live streaming

- BetUS – One of the best Illinois sports betting sites for bonuses

- Everygame – Great for odds on worldwide sports

- MyBookie – Best Illinois sports betting site with top promos

- BUSR – One of the best Illinois online sportsbooks for horse racing

- Sportbetting.ag – An Illinois betting site with competitive odds and speedy payouts

- XBet – Best mobile sportsbook app in Illinois

- Mega Dice – Wide variety of US and international sports with great lines

Best Illinois Online Sports Betting Sites and Apps Reviewed

Let’s take a closer look at the top 5 platforms for online sports betting in Illinois.

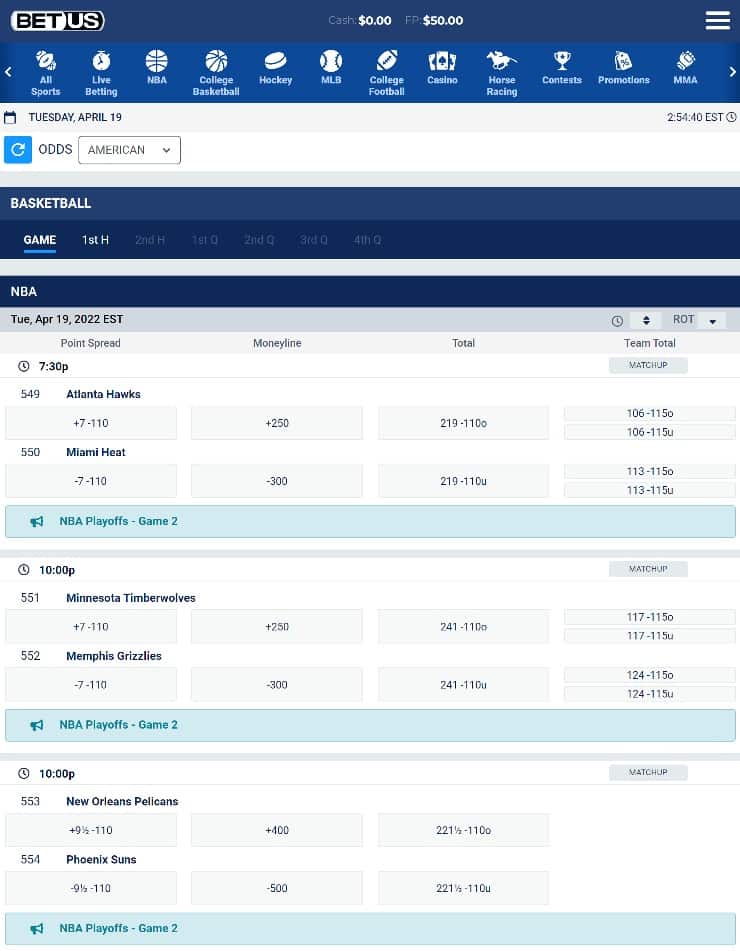

1. BetOnline – Overall Best Illinois Sports Betting Site for 2025

BetOnline is one of the most reputable sportsbooks in the industry and is our #1 rated sports betting in Illinois site for 2025. This online sportsbook stands out for its enormous range of sports, generous welcome bonus, and excellent customer service support.

On top of that, BetOnline offers in-game betting and live streaming for most matches. You can bet on all major sports such as NFL, MLB, college games like the NCAA, as well as UFC.

The BetOnline promo code welcome bonus can be used across your favorite sports, with no restrictions on what sports you can bet on or what odds you can take.

This top sportsbook also offers a massive range of betting contests across several sports, so if you’re looking for a new and exciting betting challenge with big prizes, BetOnline is one to check out.

What we like:

- A huge range of sports markets to wager on

- In-game betting and live streaming

- Contests run throughout the year

- Generous welcome bonus

- Excellent customer service support

What we don’t:

- Unlike other Illinois sports gambling sites, no PayPal payment option at MyBookie

2. BetNow – Deeper Markets on US Sports Than Most Other IL Sports Betting Sites

Bet on over 10 different sports with the BetNow sportsbook. Find them all arranged in the sidebar on the left. Click the sport you want to see and the range of markets on offer. Then choose the market you want to explore to see the matches available with that market. Their sports include options from all around the world and popular US sports. There are odds for the NHL, NBA, NFL, and MLB as well as for rugby union, golf, and car racing. You can also bet on esports tournaments and the political world.

Make a deposit with most major credit and debit cards as well as through a bank wire, with Neteller, or via Bitcoin or Bitcoin Cash which is also available for withdrawals. Traditional payout methods available are MoneyGram, bank draft, bank wire, Neteller, or direct deposits. You can deposit as much as $40,000 at a time with Bitcoin whereas traditional methods are limited to $1,000.

You can choose from two welcome offers when you join. One matches a crypto deposit or you can choose the one that matches a traditional deposit. A crypto deposit is matched 200% up to $200 whereas the welcome bonus for traditional currencies offers a 150% up to $225. They both require a rollover of 20x on your deposit and the bonus funds you receive.

What we like:

- Accepts Bitcoin deposits and payouts

- Also offers esports and political betting

What we don’t:

- Few matching deposit and withdrawal methods

- Has the lowest number of sports

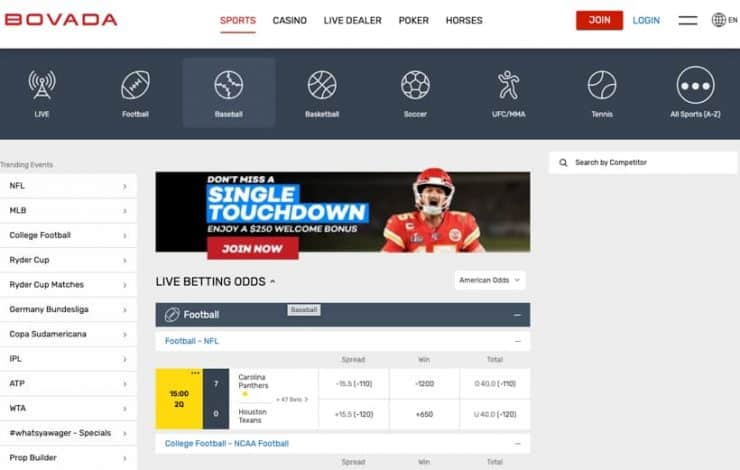

3. Bovada – Best Online Sports Betting Illinois Site for Live Streaming

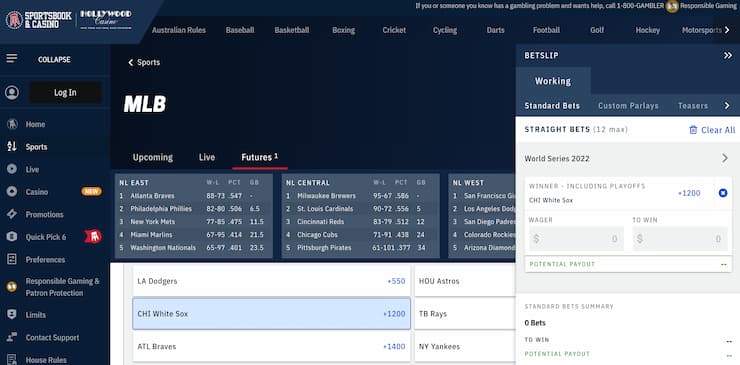

Bovada is another top pick for Illinois sports bettors who want to place futures wagers. This betting site offers NBA futures, NFL futures, and even college sports futures, this selection is unmatched by any other Illinois sportsbook.

On top of this, there is a huge variety of wager options and an impressive and easy-to-use prop builder so you can add your favorite sports betting Illinois teams to your betting slip at any time.

If you’re online betting on Illinois sports teams, Bovada offers a ton of tools and features for players, including full statistics for every match. You’ll also find a wide range of in-game bets to make matches more exciting. It also has mobile apps for iOS and Android, and these support all the same features as you’ll find on the website.

This top sportsbook offers a great deposit match for new players which you can claim using the Bovada promo code. Bovada also offers a very appealing Bitcoin promotion for new users which can be used to place bets on the wide range of sports they have on offer.

What we like:

- Wide range of futures betting markets

- Live streaming available for some sports

- Top Bitcoin promotions

- Mobile betting apps for iOS and Android

- Great welcome bonus

What we don’t:

- Lacks e-wallet payments

4. BetUS – Overall Best Illinois Sportsbook

![Top Illinois Online Sports Betting Sites and Apps [cur_year] - 100% Trusted IL Sportsbooks](https://www.basketballinsiders.org/wp-content/uploads/2023/02/BetUS.jpg)

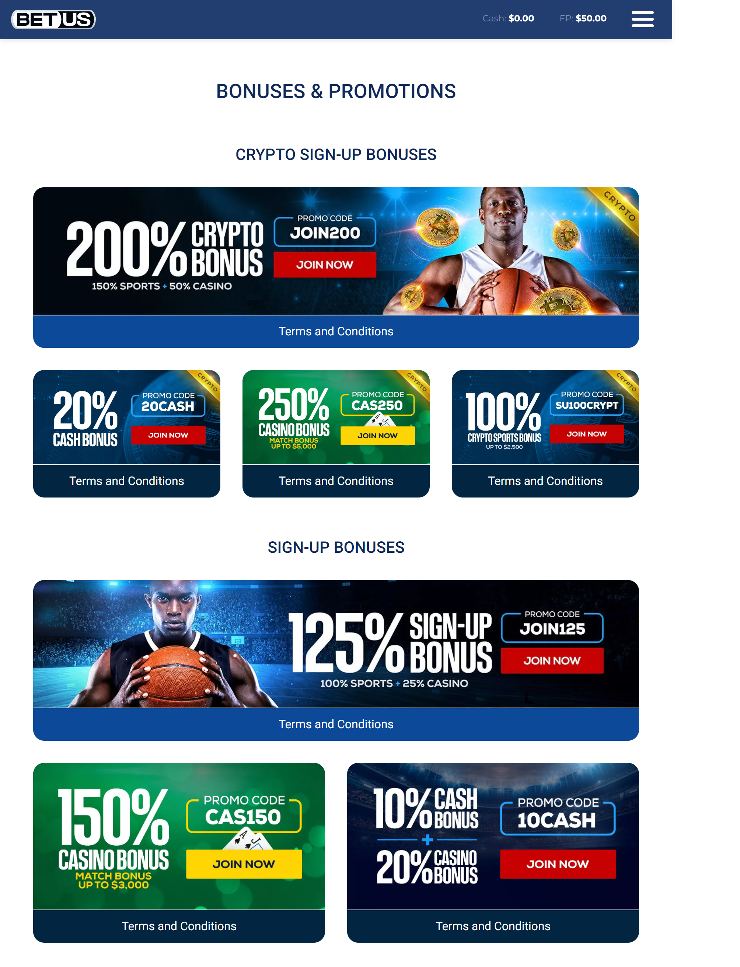

BetUS is our favorite Illinois sports betting site for players in search of the best promotions. This sportsbook offers a whopping deal for new bettors worth an enormous $2,500! All users have to do is simply enter the BetUS promo code when they make their first deposit.

Another thing we like about the BetUS sports betting Illinois site is that it tends to offer more favorable odds than other IL sportsbooks. That means that when your bet wins, you can win more than you would at competing sports betting sites. Plus, BetUS offers live betting during matches and HD streaming so you can watch the action unfold.

BetUS broadcasts odds and lines on all the major US professional and college sports leagues, plus sports like rugby, soccer, Aussie rules football, and even golf betting lines. The sportsbook also has accessible customer support with a 24/7 live chat service.

What we like:

- Biggest welcome offer around

- Favorable odds for most games

- Provides 24/7 customer support

- Offers live betting and streaming

What we don’t:

- Limited payment options

5. Everygame – Great for Odds on Worldwide Sports

![Top Illinois Online Sports Betting Sites and Apps [cur_year] - 100% Trusted IL Sportsbooks](https://www.basketballinsiders.org/wp-content/uploads/2022/09/image-19.jpg)

There are 15 sports to choose from the sidebar on the left-hand side of the sports betting site Everygame. The top sports category is sure to contain one of your favorites with football, baseball, basketball, ice hockey, and tennis all included. Each sport has leagues from the US and around the world.

There could be an improvement in the markets available in the popular US sports compared to more worldwide sports. For example, The NFL lines are mainly spread, total, or money line options. Whereas, a match coming up in the Irish Premier Division has over 15 markets with multiple choices under many of them.

The live betting page, found by clicking the option in their header bar, is magnificent. It shows all of the in-play matches in all of the sports they offer. It also shows some suggested markets. The halftime category in the sidebar shows you matches that are currently in between halves or quarters and those that are upcoming too.

Deposits are possible via all major credit cards as well as Payz, Paysafe, or eZeeWallet. Bitcoin, Bitcoin Cash, and Litecoin are available for both deposits and payouts. You can also choose check, bank transfer, User2User for withdrawals, or receive a pre-paid debit card in the post. The absolute minimum deposit allowed is $5 via Bitcoin. You can claim an 50% deposit on your first bonus worth up to $500. It expires within 100 days after you claim it and in that time you must also meet the 8x rollover.

What we like:

- Great longevity

- Easy to find live betting

- Lots of sports bonuses

- Crypto available as banking option

What we don’t:

- Reduced traditional payout options

- No live streaming

More on Gambling in Illinois…

Learn about all types of online gambling in Illinois in our expert guides below:

How We Rank the Best Illinois Betting Apps & Mobile Sites

Even in the online gambling world, not all that glitters is gold. Therefore, we took our time to thoroughly critique the best sports betting apps in Illinois. We worked closely with our team of expert researchers, paying attention to all the crucial features that make up a betting app. The following is a list of the factors that we considered and how we rank the top IL betting apps.

Mobile Betting Experience

An Illinois sports betting app must be laid out in a simple manner but offer high-tech features. The idea is to make the bettor’s life easy while serving up a thrilling gambling experience. Therefore, a competitive app must be easy to navigate and run lightning-fast on all supported devices.

Device Compatibility

We’re big on Illinois mobile sports betting apps that work perfectly on whatever device you throw at them. For one, progressive web apps are convenient as they do not require any download. These applications also almost always support multiple devices on different operating systems. Our tests revealed that most of the sites on our list perform well on most modern smartphones.

Mobile Betting Bonuses

An Illinois sports betting app will have better chances of standing out from the crowd if it offers a competitive sign-up package. For example, most sportsbooks offer a 100% welcome bonus. Top operators, however, can get you 200% or even more. Be that as it may, we also scrutinize the terms and conditions to check for fairness.

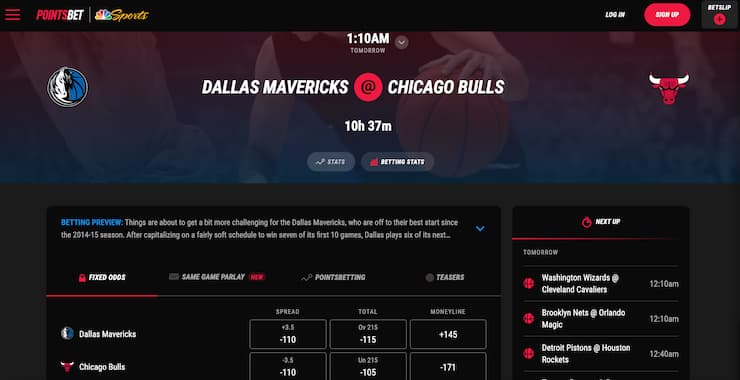

Live Betting & Streaming

In-play betting is one of the most exciting features when it comes to Illinois sports betting apps. Coupled with HD video streaming, live bets will give you a front-row seat to big events such as the NBA or the NFL Super Bowl. In our analysis, we check for betting market diversity for each app.

Banking Options

We also have to look at the deposit methods available at each Illinois sports betting app. Payment methods have to be fast, convenient, and secure for both deposits and withdrawals. The most commonly used options include credit cards, cryptocurrencies such as Bitcoin, and eWallets like Skrill and PayPal.

Customer Service

We read user comments to see what past and present customers say about each Illinois sports betting app. We also tested the various customer support platforms for ourselves. We wanted to see how fast the representatives could resolve queries.

Licensing and Security

Newcomers to online gambling hesitate to deposit money and disclose personal information to a random sportsbook. We took a moment to verify each Illinois sports betting app for licensing. Professional mobile sites also use data encryption tech such as SSL and 2FA to ensure customers’ privacy.

The Best Regulated Betting Sites and Apps in Illinois Reviewed

The top 5 sites appearing in the above selection of mini-reviews are available in most states and also provide upper betting lines on college sports, which is why we favor them slightly.

There are, however, also several geo-restricted sites that are available to bettors gambling in Illinois that are well worth checking out (if you haven’t already).

As such, we’ve reviewed Illinois sports betting online and regulated sites below:

Illinois Sportsbooks Compared

Wondering which Illinois sportsbook is right for you? We’ve put together a detailed table to help you compare the top 10 IL sportsbooks in 2025:

| Sportsbook | Sign-Up Bonus | Bonus Code | Sports to bet on | Live Betting | Live Streaming |

| BetOnline | 50% up to $1,000 | INSIDERS | 40+ | ✅ | ✅ |

| BetNow | 3x $250 up to $750 | INSIDERS | 12+ | ✅ | ❌ |

| Bovada | 75% 3x up to $750 | N/A | 40 | ✅ | ✅ |

| BetUS | 125% up to $2,500 | INSIDERS | 25+ | ✅ | ✅ |

| Everygame | 50% up to $1,000 | INSIDERS | 25+ | ✅ | ❌ |

| MyBookie | 50% up to $1,000 | INSIDERS | 25+ | ✅ | ❌ |

| BUSR | 100% up to $1,000 | INSIDERS | 20+ | ✅ | ❌ |

| Sportsbetting.ag | Up to $1,000 first 2 deposits | N/A | 25+ | ✅ | ❌ |

| XBet | 50% up to $500 | INSIDERS | 25+ | ✅ | ❌ |

| Mega Dice | 200% Bonus Up To 1BTC | N/A | 35+ | ✅ | ❌ |

Discover Our Top Betting Guides

How to Sign Up to an Illinois Betting App & Mobile Site

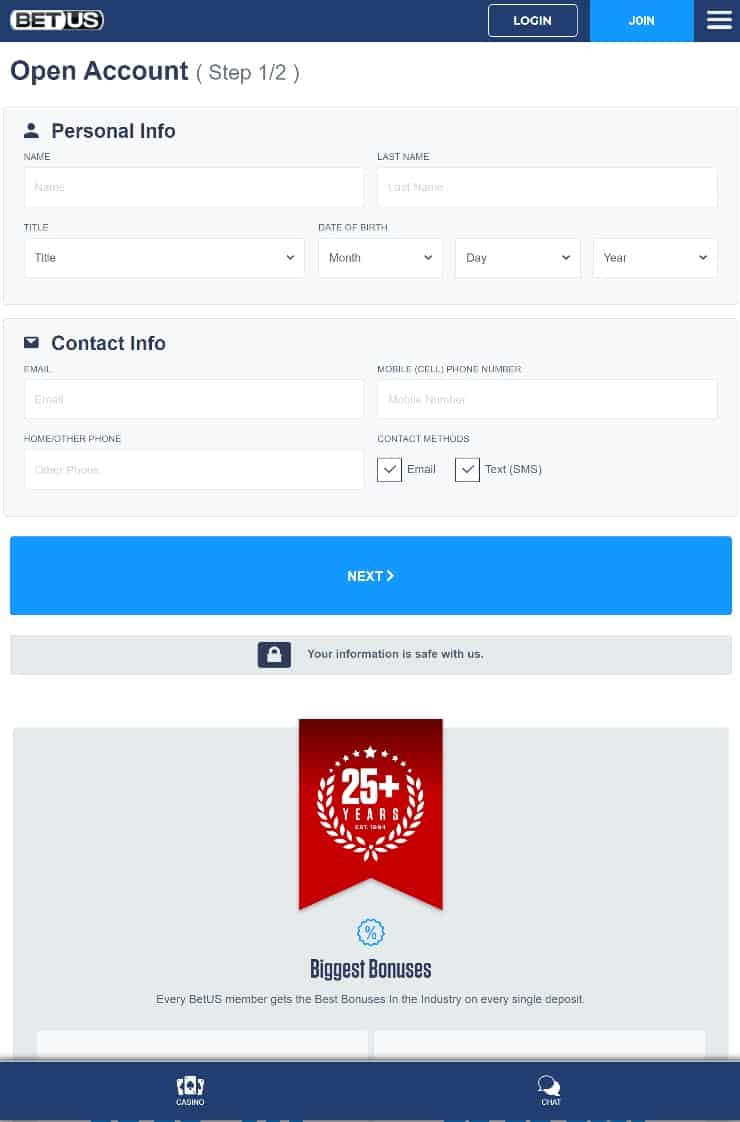

Okay, now that you have an idea of how to pick an excellent Illinois sports betting app. Let’s now walk you through the process of setting up an account. We’ll use our top mobile betting platform, BetUS, as an example.

Step 1: Create an Account

From your smartphone’s browser, tap the “Visit Now” button to navigate to the BetUS official app. Find the JOIN button and tap. You must input your personal data on the form.

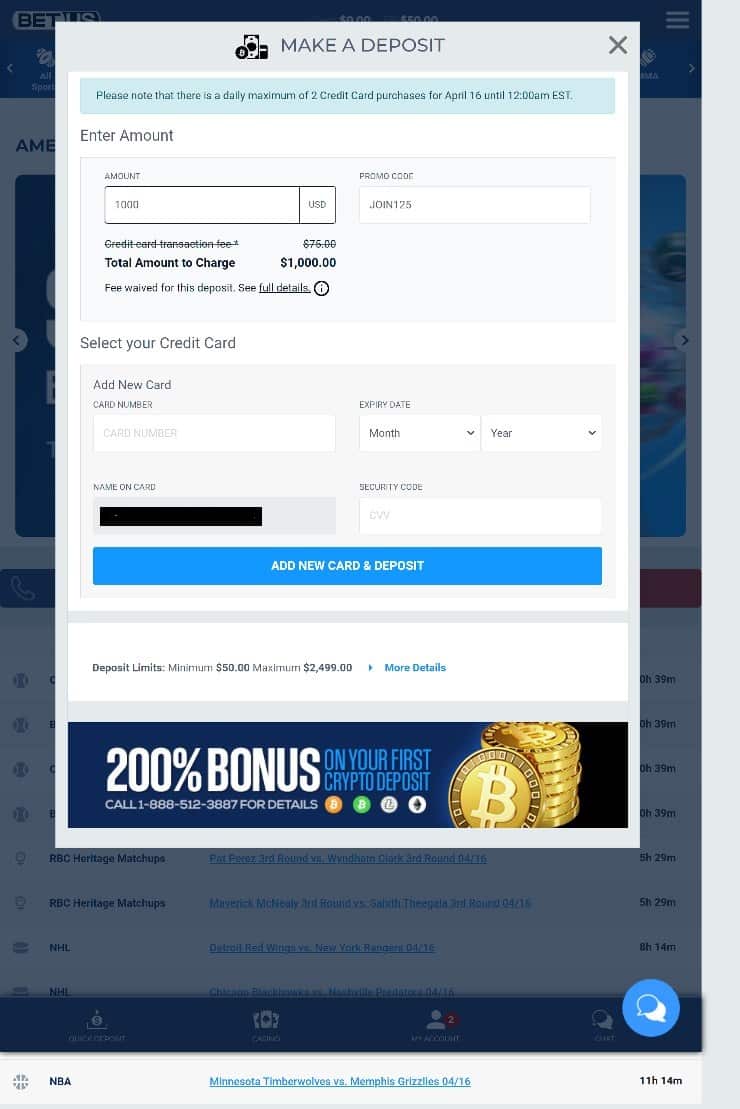

Step 2: Make a Deposit

Go to the cashier and select Deposit. The best sports betting app Illinois will show you all the available payment options such as Bitcoin and Visa. Select your banking partner and enter the amount you wish to deposit.

Step 3: Pick a Sign-Up Bonus

The Illinois sports betting app will offer a variety of sign-up bonuses. You must choose one that’s most suitable for you. Once you pick the Crypto bonus, you cannot claim another welcome offer. Enter the relevant promo code to unlock the bonus

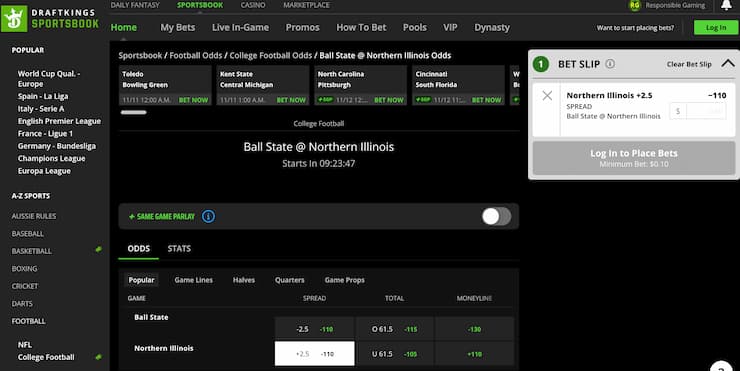

Step 4: Look for Sports and Betting Odds

Now, pick your favorite sports to bet on. Make sure that you understand the game through and through. Browse and find different markets to bet on. Look for a fixture offering the best betting odds.

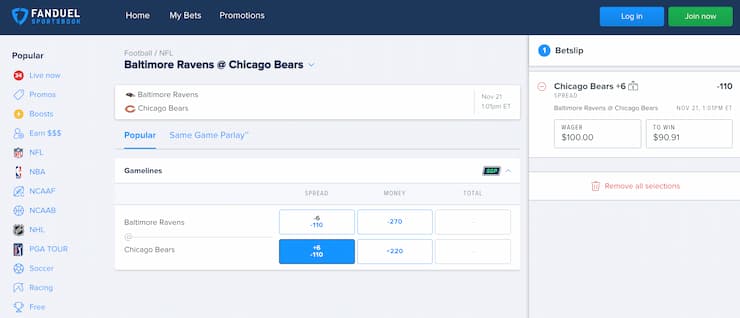

Step 5: Fill out the betting slip

After deciding on the bet type, you wish to make, go ahead and create a betting slip. All you have to do is click on the odds and click on “Add to slip” Choose the amount you wish to wager and the Illinois sports betting app will save your slip.

Illinois Betting Apps & Mobile Sites for iPhone & Android

It is obvious that signing up with a top Illinois sports betting app brings with it convenience and other massive perks. Nonetheless, compatibility is crucial when accessing a betting site via your mobile device. Two major operating systems are dominant in Illinois—Android and iOS.

Apps and Mobile sites with iPhone

The Apple brand commands respect in the US and the rest of the world. Customers can easily get an Illinois sports betting app for free from the official Apple App Store. Alternatively, a site may include a download link.

Instant-play mobile sites don’t typically have issues with compatibility as long as your phone is iPhone 8 or better. Although working on a larger display is much easier, betting sites are optimized to fit any screen size.

Apps and Mobile sites with Android

Other alternative brands to iPhone such as Samsung, operate on Android. There might be a difference between the two systems, but Illinois mobile sports betting apps work the same on Android and iOS platforms.

Betting sites will normally support any device running on Android 5 or better. Sometimes, you may need to turn your device to landscape mode to view complex data like match stats. Overall, Android sports betting apps offer a world-class gambling experience.

Mobile Site vs App for Betting in Illinois

Although they both work perfectly, mobile sites and apps are completely different. The design of a web Illinois sports betting app will contribute to efficiency. But let’s look at some general advantages and disadvantages of mobile sites and betting apps.

Sports Betting Mobile Site

A mobile site is accessible via your smartphone browser and will load up instantly without taking up storage on your device. The betting experience will also depend on the quality of your phone’s browser.

What we like:

-

- No need for extra storage space on your phone

- You can complete your Illinois sports betting online registration instantaneously

- The operator will constantly run system upgrades for you

- Instant-play mobile sites are widely available

What we don’t:

- On site system updates may take significant periods

- Not built for a specific OS and may be clunky on some devices

Sports Betting Mobile App

Since most Illinois punters prefer playing on various devices, a native Illinois sports betting app will ensure better compatibility. You would need some storage space. However, with modern phones now packing up to 1 TB of storage, there’s no problem.

What we like:

-

- An Illinois sports betting app is pretty simple to start up with one tap

- Better safety and security than mobile sites

- Optimized for specific operating systems

- Always fits properly on mobile screen

What we don’t:

- Won’t support devices made earlier than Android 5 or iPhone 6

- Needs frequent updates and extra space

How to Create a Betting App for an Illinois Sportsbook

Not all sportsbooks in Illinois have a native app. Nevertheless, if you want to enjoy a seamless on-the-go betting experience, here is a little trick you can try. You can create an app for your favorite betting site in under a minute. Here’s how.

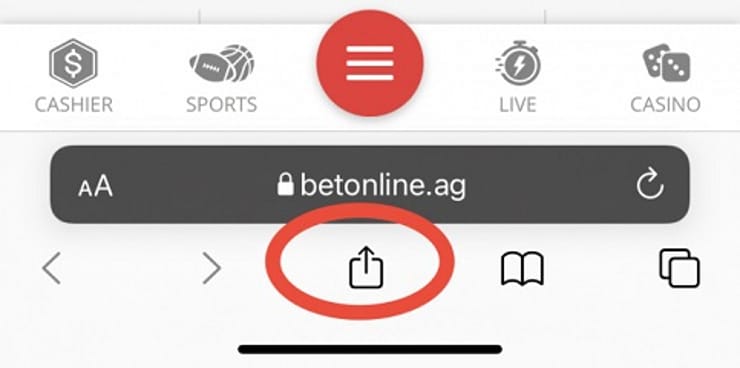

Step 1: Open the Mobile Website

Open your mobile browser —Safari on iPhones. Go to the sportsbook of your choice by tapping the “Visit Now” button.

Step 2: Open the Browser Menu

Now tap on the drop-down browser menu to expose various options. You will find this at the bottom of the page. Try not to mistake the bookie menu with the browser menu.

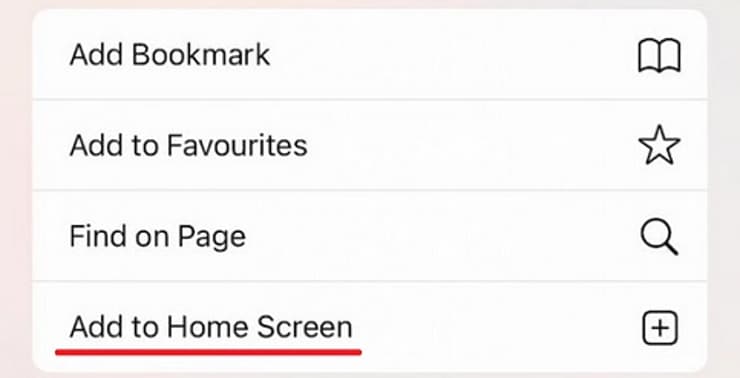

Step 3: Pick the Add to Home Screen Option

You will see several options. Look for the tab that reads “Add to Home Screen” and tap it. By doing this you will create a shortcut link to the mobile betting site.

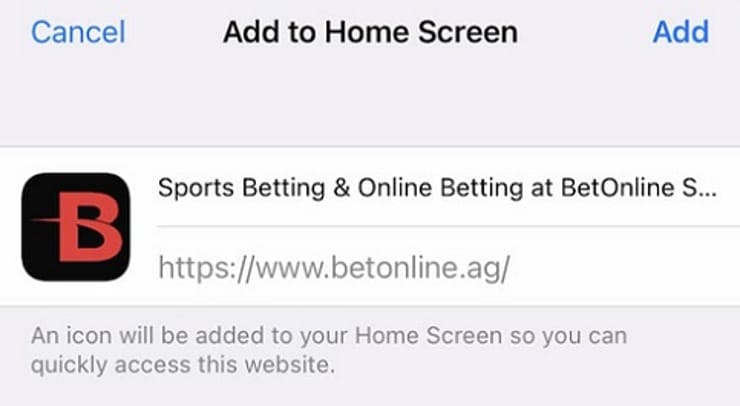

Step 4: Customize the App

For ease of operation, you can choose to rename and move the app shortcut link to an accessible location on your home screen such as a folder for gaming apps.

Step 5: Start the App

Now you can simply log onto your betting app with just a single tap. This will save you a lot of time.

![]()

Is Mobile Sports Betting Legal in Illinois?

Several states embraced online sports betting after the PASPA Act was repealed by the Federal Government in 2018. The first locally licensed Illinois sports betting app launched in 2020 and several others became available by mid-2021. However, the industry was disrupted momentarily by the global Corona Virus pandemic.

Until March 5 2022, State laws demanded that punters wishing to use Illinois betting apps had to register in person. This meant that an online sportsbook needed to have a land-based facility too. Illinois customers can also safely access offshore sports betting sites which are licensed abroad. These mobile web apps offer more competitive betting options and bigger bonuses.

Who Can Bet on Sports in Illinois?

Sports betting is legal in Illinois, both in retail and mobile settings. To wager, you must be 21 years of age and located in the state of Illinois at the time you wish to wager.

Alternatively, you can explore offshore sportsbooks that require you to be 18 years of age.

Previous Sports Betting Bills in Illinois

2022

- HB 3136: This bill allowed for mobile sportsbook registration. Before this, you needed to go to the sportsbook to create an account.

2019

- HB 3136: This bill legalized sports betting in Illinois.

Tax on Sports Betting Winnings in Illinois

At present, there is a flat sports betting tax rate of 4.95% in the state of Illinois.

Read Our Sportsbook Payment Guides

Payment Methods Available in Illinois

Below are various payment methods to fund your online sportsbook account.

Crypto Betting Options

At offshore sportsbooks, you can use any of the following cryptocurrency options. However, at some sites, there are even more options than this.

- Bitcoin

- Ethereum

- Dogecoin

- Binance

- Avalanche

- Cardano

- Tether

- Litecoin

- Stellar

- Bitcoin Cash

- Shiba Inu

eWallet Betting Options

Acting as either a middle-man between your bank account and your sportsbook account or using the balance in your account, you can use eWallets, such as the following:

- PayPal

- Neteller

- Skrill

Traditional Payment Methods at Illinois Betting Sites

Don’t worry—there are other more traditional methods you can use to fund your account.

- Credit/Debit Cards

- ACH Transfer

- Online Banking

- Check my mail

- Wire Transfer

- PayNearMe

Bonuses Available at Illinois Online Sports Betting Sites

Deposit Bonuses

Perhaps the most popular welcome bonus, a deposit bonus gives you a percentage match up to a certain dollar amount.

Let’s use an actual offshore sportsbook as an example.

- Site: BetOnline

- Deposit Bonus: 50% up to $1,000

- Wagering requirement: 10x

With this offer, if you deposit $200, you will receive a credit of $100. However, you must wager $1,000 on the site to withdraw it as cash, as all bonuses are non-withdrawable.

Reload Bonuses

Available to all players where offered, a reload bonus is a deposit bonus, usually consisting of smaller prizes and percentage matches compared to a deposit bonus welcome offer.

To utilize these, you will either need to use a promo code during your deposit or by opting into the offer.

Risk-Free/Free Bet

When you wager using a risk-free bet, you will receive the wager back in site credit should you lose. You can use the site credit again as a second chance to win money.

No Deposit Bonus

By receiving a small bonus to your virtual wallet, you will have received a no deposit bonus.

This is a small boon to your account simply for creating an account. These bonus funds carry a small wagering requirement, typically 1x.

Grab The Best Promo Codes With Our Reviews

Popular Sports to Bet on in Illinois

The major city in Illinois is Chicago, one of the biggest sports cities in America.

Here, we will cover all of the major professional sports in the US and those most popular in the Prairie State.

NFL Sports Betting in Illinois

The NFL is one of the most wagered-on sports in the world, and with that, every online sportsbook we recommend offers excellent odds that are all relatively close to one another.

You will wager on the moneyline, spread, totals, props, and more here.

- Chicago Bears – Won their only Super Bowl in 1985.

NBA Sports Betting in Illinois

BetOnline is the pre-eminent source of both NBA and college basketball betting. Here, you will have great odds, odds offered before other sites, and markets such as futures and props.

- Chicago Bulls – Six NBA Championships, all coming in the 1990s.

MLB Betting in Illinois

Bovada has offered great odds on baseball since it launched in 2011. You will have the same bet types as the NBA and NFL with baseball.

Bovada has offered great odds on baseball since it launched in 2011. You will have the same bet types as the NBA and NFL with baseball.

- Chicago Cubs – Won their first World Series in nearly 100 years in 2016.

NHL Betting in Illinois

MyBookie is the site to go to for NHL betting. The hockey odds get broadcast faster than at most rival sites and tend to be among the most competitive. Bet types include the same as MLB, NFL, and NBA.

- Chicago Blackhawks – Won three Stanley Cups from 2009 to 2015.

NCAAB Betting in Illinois

Like the NBA, you will have not only the same bet types but also the same best source—BetOnline. Of course, college basketball does have March Madness which is the focus of sports betting when it comes around.

- Illinois Fighting Illini – Won the 1915 Helms national championship.

- Loyola Ramblers – Made it to the Final Four in 2018.

- DePaul Blue Demons – Have been to two Final Fours.

NCAAF Betting in Illinois

With college football, you’ll wager on the same things as the NFL, but there are added futures markets for the numerous awards. Also, like the NFL, you can bet on the sport at any of our recommended sportsbooks with confidence.

- Illinois Fighting Illini – Last won the Kraft Fight Hunger Bowl in 2011.

- Northern Illinois Huskies – Won the MAC Conference in 2021.

- Northwestern Wildcats – Have an all-time record under .500.

- Eastern Illinois Panthers – Have produced players like former Dallas Cowboys quarterback Tony Romo and current San Francisco 49ers quarterback Jimmy Garoppolo.

Golf Betting in Illinois

![Top Illinois Online Sports Betting Sites and Apps [cur_year] - 100% Trusted IL Sportsbooks](https://www.basketballinsiders.org/wp-content/uploads/2023/02/Betonline-golf.jpg)

Boasting such iconic courses as Glen View, betting on golf is big business in Illinois. Bettors can wager on outright winners and top-five, 10, 15, and 20 finishes at most betting sites. Bovada would be our pick, though: the site offers excellent odds on golfers in all tournaments, especially golfers who are the top favorites.

Horse Racing Betting in Illinois

Horse racing is legal in Illinois. However, if you want to stick with one of the offshore sites, BetUS and BetOnline offer multiple races worldwide to bet on every day.

There are numerous ways to wager on horse racing, but the more popular methods are win, place, show, exacta, daily double, and picks 3-6.

- Arlington Park

- Balmoral Park Harness Racing

- Fairmount Park

- Hawthorne Race Course

- Maywood Park

DFS is Legal in MI

You can craft a lineup at sites like DraftKings and FanDuel while staying under the salary cap to compete in competitions for millions in cash prizes.

Live Betting with Illinois Online Sports Betting Sites and Apps

If you’ve ever forgotten to bet on a contest before it started, you no longer need to worry about live betting. This feature is available on all of the sites we recommend. There are dedicated pages for completing this type of wager, and the odds shift quickly as the game progresses.

Learn More About Betting With BBI Guides

Sports Bets that are Illegal in Illinois

In Illinois, you cannot currently wager on any college sports games taking place in the state.

How Illinois Stacks Up to the Nearby States

Illinois borders five states: Wisconsin, Indiana, Kentucky, Missouri, and Iowa.

Of those states, Indiana and Iowa are entirely legal, Missouri is moving toward legalization, and Kentucky and Wisconsin are not legal yet.

Casinos with Sports Betting in Illinois

In Illinois, seven casinos offer sports betting in a retail setting.

- Rivers Casino

- Argosy

- Grand Victoria

- Casino Queen at DraftKings

- Hollywood Aurora

- Hollywood Joliet

- Par-A-Dice

- PointsBet Sportsbook at Hawthorne Racetrack

IL Legislative Resources

For residents of Illinois interested in finding out more information on current legislation to do with sports betting and gambling in the state or would like to contact local and state representatives to express their opinions or concerns on the subject they can use the links below.

IL Gambling Resources

If you believe that you or someone you know has a gambling problem, then we encourage you to get in contact with the NCPG Illinois, Illinois Gaming Board, or the Illinois Department of Human Services found at the links below, they can provide advice and local information, and treatment services in your area.

Best Online Illinois Sportsbook

While we recommend you explore all of the sportsbooks on our list to see which one fits your needs, we rank BetOnline atop the rest due to its welcome bonus, favorable odds, and 24/7 customer service.

50% Up To $250 + 100 Free Spins

- Impressive number of sports betting markets

- Competitive promotions and odds

- Great range of payment methods available